COVID-19

Lockdown Paradox

Date: May 7, 2020

Social Protection and COVID-19

Introduction

As of end April 2020, Pakistan has more than 16,000 confirmed cases of COVID-19, and over 350 deaths.1 As this human tragedy unfolds, more material concerns are also being debated alongside. Along with2 much of the global economy, Pakistan too, is expected to undergo a recession – only the second in its 73-year history (the first was in 1951-52).

The implications of this for a workforce of almost 60 million are staggering. In the event that the pandemic does not abate in the near future (and this indeed is what is likely), it falls upon the State to ensure that the basic needs of at least the poorest sections of society are provided for. This paper argues that social protection and relief are the State’s key weapons in this fight against COVID-19. Rather than endangering lives by rushing to allow economic activity, the emphasis has to be on devising the means to cover the most vulnerable sections of the population.

Economic Implications of COVID-19

The World Bank estimates that growth in Pakistan in FY 2020 will contract by 1.3 per cent,3 as a result of the slowdown in economic activity in the last four months of the fiscal year.4 The outlook is not very positive for the near future either – growth is not expected to recover before FY 2022, when it is expected to reach barely 3 per cent. The agriculture sector is likely to emerge relatively unscathed (barring the vagaries that it is subject to anyway, due to fluctuations in water flows, pest attacks and unfavourable weather conditions). However, manufacturing is highly vulnerable. Only units producing essential items are in operation March 2020 onwards, and even the ones that are working are plagued by supply chain disruptions. The services sector, which typically accounts for more than half of the GDP, has been badly hit as retail and wholesale trade has crumbled, and transport, storage and communication are largely inoperational. In essence, about 80 per cent of the economy is badly affected.

The implications of this for the workforce are staggering. Economists at the Pakistan Institute of Development Economics (PIDE) analysed data from the Labour Force Survey 2017-18, and found that up to 18 million people, or about a third of the total labour force, could lose livelihoods, particularly if the economy moves towards a complete shutdown.5 Two thirds of those rendered unemployed are likely to be daily wagers.

The federal government’s response to this scenario has been marked by confusion. It has resisted a strict lockdown, and has time and again stressed the need to allow economic activity to resume. In this, it has been thwarted by three provincial governments (Sindh, Balochistan and later Punjab) and by the medical community, which has come out through its designated professional associations to warn policymakers of the potentially disastrous consequences of a resumption of business as usual. As things stand now, a (smart?) lockdown is in place throughout the country until at least mid-May. What all it covers and the extent to which it is being enforced varies from province to province and in the federal territory.

While it is impossible to deny the potentially devastating effects of a lockdown on the economy, international experience suggests that relaxing rules on movement and interaction are likely to prolong the pandemic. What should the government then do?

COVID-19 Social Protection Measures

The first COVID-19 case was confirmed in Pakistan on February 26, 2020. Within weeks it was clear that the number was going to go up substantially, beginning with cases detected in travelers returning to the country, and progressing to local transmission.

Multi-sectoral Relief Package, March 2020

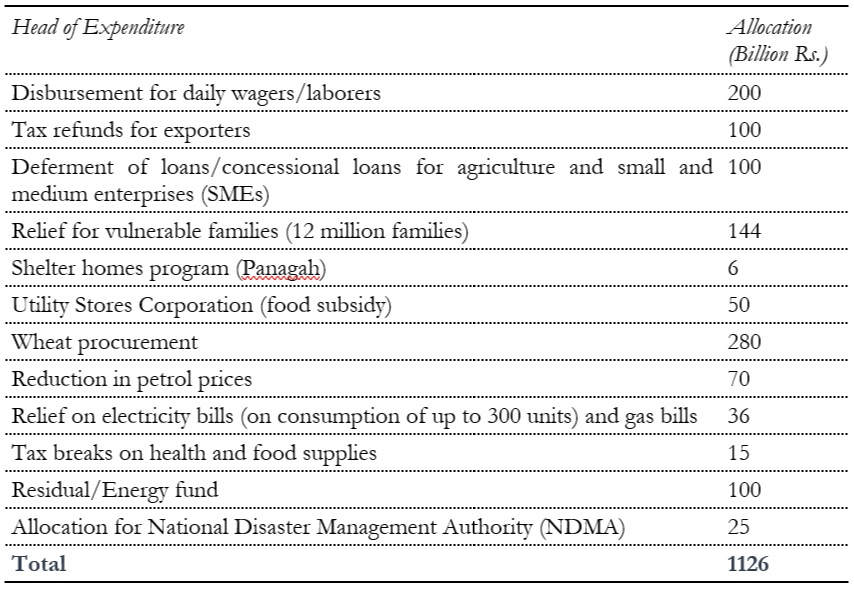

The government announced its first major relief package on March 25, when Pakistan’s total confirmed cases had just crossed 1000.6 This qualified as the single largest poverty relief package ever issued by the Pakistan Government, and included relief measures worth Rs. 1.25 trillion. Of the total, Rs. 200 billion was to be distributed to daily wage laborers (mainly as food packages). Rs. 144 billion was to be distributed as cash relief in the form of a lumpsum payment of Rs. 12,000, to vulnerable families, as identified through the Benazir Income Support Programme (BISP) registry. An estimated 12 million families are expected to benefit from this initiative.

The relief amount for households was calculated as Rs. 3,000 per month for four months, with Rs. 3000 estimated to be the typical expenditure on groceries for an average family in a month. It is to be kept in mind, though, that this amount is just 17 per cent of the federal government mandated minimum wage of Rs. 17,500.7 The Household Income and Expenditure Survey (HIES) reported that 37 per cent of total household expenditure is typically on food for families in Pakistan in general.8 Applied to the minimum wage, this means that typical food expenditure for an average household comes to about Rs. 6,475. The relief package thus just about provides the means for families to avoid starvation – it cannot be considered as a means to cover even basic food requirements. Nevertheless, it appears that the choice was between increasing the number of potential beneficiaries vs. providing substantial relief to a smaller number. The number of households receiving the unconditional cash transfer from BISP is currently 4.7 million – and these are considered the most vulnerable households as per the last BISP poverty scorecard survey completed in 2010.9 The government’s decision to almost treble that number of beneficiaries for the COVID-19 relief package makes sense, given the widespread poverty impact of the pandemic.

The expenditure heads proposed under the package are given in the table below.

Table 1: Breakdown of Prime Minister’s Relief Package – March 2020

Source: Press statement, Ministry of Finance.

A quick analysis of the package shows that about 40 per cent of the allocation is in the form of direct relief to the poor (allocations for daily wagers and vulnerable families, food subsidy through Utility Stores, funds for shelter homes, and relief on utility bills). About 60 per cent of the package does provide relief for vulnerable segments of society, but is also aimed at protecting losses in commodity producing sectors, and those engaged in production processes. These allocations included ones for tax refunds and tax breaks, deferment of loans, wheat procurement and the energy fund. Thus, the government appeared to be targeting two fronts even in a relief package being touted as a safety net provision for the poorest of the poor.

Package for Unemployed Labourers and Small Businesses

Another package was announced by the Prime Minister on 2nd May, which aims to provide relief to labourers and small businessmen. The Prime Minister said that the Ehsaas program, the government’s flagship social protection entity, has launched a portal to register unemployed labourers, who will then be provided cash grants of Rs. 12,000 total issued in instalments. The package also includes provisions for payment of electricity bills of small businesses for up to three months. According to an earlier statement, Rs. 75 billion has been approved for the package, which will benefit about 3.5 million small businesses. It is not clear if this package is a subset of the multi-sectoral relief package described earlier, or is a new initiative.

Ehsaas Ration Portal

A donor-beneficiary linking portal, which was made operational in end April, the Ehsaas Ration Portal requires both donors and potential beneficiaries to register with the program. Beneficiary data will be scrutinised against the Ehsaas database to ensure eligibility, while donor data will be assessed for transparency and tax compliance. The Portal will allow donors to provide cash or food rations for distribution to eligible beneficiaries. The Portal is targeting large corporate donors (annual revenues of over Rs. 2 billion) as well as NGOs (approved by the Ministry of Interior). This is a new initiative, the success of which will be monitored by the Ehsaas program over the coming months.

Possible Corona-led Budget

According to the Advisor for Finance, the budget for FY 2021 will be a “Corona-led” budget with a focus on relief and rehabilitation. While tax collections are likely to fall far short of targets, given the shrinking of the economy in the second half of the current fiscal year, the government is getting significant relief from rock bottom oil prices, and fiscal concessions granted by the IMF which has committed $1.4 billion through its rapid financing facility to combat COVID-19.10 While appreciating Pakistan’s response, the IMF observed that relief measures must be “targeted and temporary” given Pakistan’s ongoing fiscal challenges.11 This, of course, is under the assumption that the COVID-19 global crisis will abate by the second half of 2020 – something that is impossible to predict.

Social Protection as a Crisis Response

Ramping up social protection measures was perhaps the key requirement in the current scenario when the estimated 70 million plus persons in Pakistan who already fall below the poverty line are at their most vulnerable. The need for the State to provide cover is even more pronounced when one considers that those already beneath the poverty line are likely to be joined by perhaps another 20 million or so who may be rendered jobless and with no access to wage labour. We discuss some of the key features of the social protection response of the government.

Extend Protection to the Poor

The multi-sector relief package was a step in the right direction, but doesn’t go far enough. Although inflation is likely to remain low in the wake of lower oil prices, 12 it is still unrealistic to expect that a household of 6 to 7 persons (the average family size in Pakistan) can manage expenditure on food and other essentials (fuel, medicines) on Rs. 3,000 per month. The government acknowledges that the relief package is meant to avert a food emergency rather than relieve poverty. However, in a situation where income earning opportunities are fast disappearing, it is important to do more than just take the edge off hunger. This is a crisis situation, and it should be possible to marshal resources from other heads of expenditure. The government may also consider reviewing the public sector development programs at the centre and in all four provinces and allocating funds only for essential projects, or those that will contribute to relief efforts in the current crisis. There is little doubt that any comprehensive social protection program will cause the fiscal deficit to balloon. But the alternative is a citizenry that realises that its welfare was not a top priority. That is a situation to be avoided.

Relief Package to Emphasise Protection

As such, the government’s multi-sectoral relief package was a much-needed policy statement, and a boost in the arm for the poorest sections of society. Nevertheless, even the relief package that was supposed to address a poverty crisis includes many elements that benefit producers and entrepreneurs. While it can be argued that these economic agents enable job creation, and thus contribute significantly to poverty alleviation, it is also true that resuming economic activity could possibly expose large sections of the population to an unprecedented health crisis. It may be wise to adopt a phased approach wherein the immediate disbursement from the package should be on income support for the poorest, and on health facilities, thus demonstrating the State’s commitment to preserving life above all else.

Targeting Through BISP Scorecard Survey to be Supplemented

The poverty scorecard survey on which BISP disbursements are currently based was carried out in 2009-10. In Pakistan, where almost 20 per cent of the population is estimated to be vulnerable to poverty, while a further 18 per cent are clustering around the poverty line, a lot can change in ten years.13 A recent review of BISP beneficiaries was revealing as it included those who had government jobs, those who had travelled abroad more than once, and those who had paid mobile phone bills of more than Rs. 1,000 in a month, to name just some of the categories against which beneficiaries were assessed. While some of the additions in the list of beneficiaries could be traced back to fraudulent practices, it is also possible that some of the beneficiaries who were removed were simply those whose circumstances were quite different ten years ago.

Just as the status of BISP beneficiaries was evaluated using other publicly available databases – cell phone bill payment records, utility bills, records of travel and employment, etc., it is possible to identify those deserving of financial support through the same means. Thus, it may be acceptable, for example, to stipulate that all those whose utility bills show consumption of units below a certain level, consistently over a period of some months, will be eligible for financial support. The government can continue using the BISP database for one lot of disbursements, but may consider supplementing that through other such means of identification to account for possible significant changes in economic status.

Support to the Non-Government Humanitarian Sector

The government’s relations with NGOs have been dire of late, with a host of new regulations on registration and grant of no objection certificates etc. The authorities claim that scrutiny of NGOs was necessitated by the covert support being extended by some notorious organizations to extremists and terrorist groups, as well as other “anti-state” elements. While the need to regulate such instances is appreciated, the authorities have in effect succeeded in rendering NGOs in-operational and largely ineffective when it comes to providing relief to marginalised communities. NGO personnel typically cannot travel freely across the country, meet with communities, or collect data. While some charity organisations continue to flourish and are doing excellent work during this crisis, there is a need to be more inclusive. The government should consider allowing a range of development NGOs, who have been constrained in recent years, but who are skilled in community level operations, to take to the field and assist in relief. There is no greater threat to national security than a despairing, desperate citizenry that does not trust its rulers or society in general, and feels ignored.

Avoid Mixed Messaging

The federal government’s response to COVID-19 has been characterised by mixed messaging. The statements of various members of the government have run the gamut from saying that this is a mild affliction that is unlikely to affect anyone other than the elderly, to advocating debt relief for less developed countries in the wake of the disaster that the pandemic is unleashing. The government’s concern for the economy is understandable. Nevertheless, the immediate concern should be the preservation of life. It is important to reassure people that resources will be diverted such that they do not face severe deprivation, although a loss of livelihoods is inevitable. Presenting a scenario where people are being told that they will starve unless they work will only add to panic, in addition to possibly endangering them and conveying a sense that the citizens of the country are on their own in the face of perhaps the worst health crisis the country has faced.

In the same vein, the government’s mixed messaging on the ferocity (or otherwise) of the pandemic in Pakistan is also creating false expectations. In recent days, a number of prominent politicians, including the Prime Minister and the Minister for Planning, have reiterated that numbers are better than expected, and that the incidence of the disease in Pakistan is lower than envisaged. The cause for this complacency is not clear, however, given that Pakistan’s testing rates are poor if not abysmal.

All that can be said with some authority is that mortality rates, as a proportion of confirmed cases, are not as high as in most western countries. Nevertheless, until testing ramps up significantly, it is not possible to assert that Pakistan has somehow escaped the worst-case scenario.

Conclusion

The latest modelling of the COVID-19 pandemic suggests that the virus will only begin to fade out in Pakistan in July 2020. The government is discussing an ease in the (already weak) lockdown. The measures being debated are the opening of more industries, some sectors such as construction, and even opening up some routes to public transport in the run up to the Eid holidays in end May. With daily case increases now nearing a 1,000, this is a highly risky strategy. The repeated assertion is that as a poor country we cannot afford an indefinite lockdown. This view does not account for the fact that allowing people to be exposed to a potentially deadly disease is hardly going to help the economy in the longer run, not to mention exacerbating issues of poverty and marginalisation. The government has an opportunity to demonstrate concern for the welfare of its citizens. If this means taking unpopular decisions, then it must do so, and explain its line of reasoning to the people. COVID-19 has changed the world. It is unlikely that humankind will not feel the impact of this pandemic for a long time to come. Now is the time for Pakistan to chart a new course where the health and safety of its people are first and foremost.

References

1 Based on less than 200,000 tests. Per day testing so far has been about 8000 tests. The number of tests is too low to get an accurate picture of incidence of COVID 19 – it is fair to surmise that the actual number of infected persons is far higher than what official figures convey.

2 See https://www.worldbank.org/en/country/pakistan/overview. Accessed 27 April 2020.

3 The fiscal year in Pakistan runs from 1 July to 30 June. The form FY2020 refers to the fiscal year ending in June 2020. The same convention holds for other fiscal years cited in this paper.

4 PIDE. (2020). Labour Market and COVID 19. COVID Bulletin No. 13. The paper posits that the bulk of jobs lost will be those engaged in the agriculture sector, but that probably refers to rural populations engaged in off-farm employment, mainly daily wage labour.

5 Data from http://covid.gov.pk/stats/pakistan. Chart titled COVID 19 – Overview.

6 Provincial governments notify minimum wage rates separately, but these do not differ substantially from the rate mandated by the federal government.

7 Pakistan Bureau of Statistics. (2016). Household Income and Expenditure Survey 2015-16. Table 3.7.A of section titled Write Up.

8 A new census or National Socio-Economic Registry (NSER) data collection process is currently underway, but its not clear when results will be available. As of now, BISP is relying on somewhat outdated data for household targeting.

9 Press Release: IMF Executive Board Approves a US$1.386 Billion Disbursement to Pakistan to Address the COVID-19 Pandemic. PR 20/167. April 16, 2020.

10 Ibid. Paragraph 18.

11 LNG and furnace oil prices are likely to fall as well and create relief for disposable incomes. Oil is the base price, and most other forms of energy pricing are linked to it.

12 Poverty figures from Ministry of Planning, Development and Reform. (2018). National Poverty Report 2015-16. Table 5.

13 As announced by Minister for Planning Asad Umer on April 29, 2020. See https://www.arabnews.pk/node/1666946/pakistan